december child tax credit amount 2021

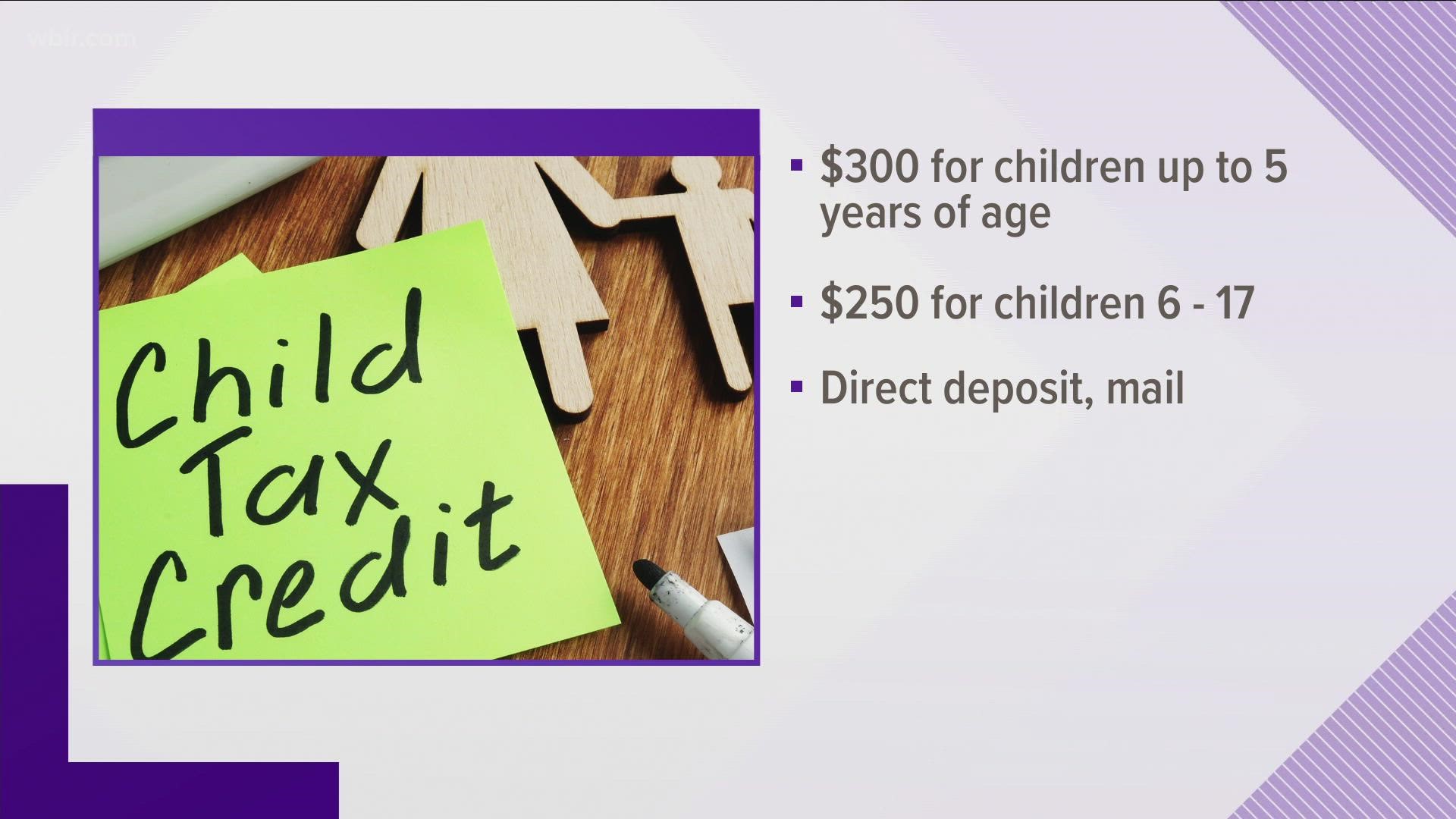

For eligible families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. How much money will families have received from Child Tax Credit by December 2021.

Added January 31 2022 Q A10.

. With the new addition I would. CHILD TAX CREDIT. Child tax credit for baby born in December 21.

The child tax credits are worth 3600 per child under six in 2021 3000 per child aged between six and 17 and 500 for college students aged up to 24. When you file your taxes for 2021 in 2022 you will receive the other half of the benefit. Thats because the expanded CTC divided the benefit between monthly checks issued starting in July and ending in December with the other half to be claimed on tax returns.

Is my Child Tax Credit refundable. Through the year I received half of the advanced CTC for the other children aged 9 5 4 2. Last year President Joe Biden signed the American Rescue Plan which increased the child tax credit CTC amount and offered half of the credit through a series of monthly payments.

And unless Congress decides to extend the monthly payments the final installment will come in December. This is up from the 2020 child tax credit amount of 2000. Added January 31 2022 Q A9.

That means theyll receive 167 per child who is 17 or younger through December representing half of the 2000 regular CTC. In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older. But Im running into some things that Im not sure about with everything going on in 2021 and the CTCs.

The credit was increased from 2000 per child to 3000 per child ages 6-17 and 3600 per child up to age 5. Typically the child tax credit provides up to. How does the first phaseout reduce the 2021 Child Tax Credit to 2000 per child.

For parents with children 6-17 the payment for December will be 250. How does the second phaseout reduce the Child Tax Credit amount remaining after the first phaseout. In January 2022 the IRS will send Letter 6419 with the total amount of advance child tax credit payments taxpayers received in 2021.

For 2021 taxpayers with qualifying children were eligible to receive a child tax credit equal to. Families will receive the other half when they submit their 2021 tax return next season. The child tax credit has been increased from 2000 to 3000 or 36000 depending on the age of the qualifying child.

Families will see the direct deposit payments in. If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2021 you can expect to receive up to 1800 for each child age 5 and. A CTC calculator from Omni Calculator lets users check how much.

Half the amount 1800 was available in six. Some families may have opted out of advance payments earlier in the year meaning they will receive up to 3600 per child when taxes are filed. 3600 for children 5 and under andor 3000 for.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5. The child tax credit for 2021 pays out 3600 for each eligible child under the age of six. For parents with children aged 5 and younger the Child Tax Credit for December will be 300 for each child.

Here are more details on the December payments. Under the enhanced CTC. Taxpayers with qualifying childrendependent between the ages of 6 and 18 get 3000.

Child Tax Credit Amount for 2021 The American Rescue Plan Act of 2021 raised the amount of the child tax credit to 3000 per child or 3600 per child under age 6. If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and younger or up to 1500 for each child aged between six. If you have not yet received the monthly payments - up to 300 for children under six and 250 for those aged between six and 17 you should use the Get CTC Online Tool to submit a claim.

The child tax credit and your 2022 tax return. Child 5 was born Dec 3rd. Added January 31 2022 Q A11.

For children under 6 the CTC is 3600 with 300 optional monthly advanced payments. If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2021 you can expect to receive up to 1800 for each child age 5 and. Doing the math that was 1380026900 over the six months.

While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to receive the full amount of 3000 for each child. The final payment for the. People then need to claim the remaining portion of their child tax credit on.

However theyre automatically issued as monthly advance payments between July and December -. Payments in 2021 could be up to 1800 for each child under age 6 and up to 1500 for each child ages 6 through 17.

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Did Your Advance Child Tax Credit Payment End Or Change Tas

Why You Should Wait To File Taxes If You Received Child Tax Credits In 2022 Filing Taxes Child Tax Credit Tax Credits

Ed Markey On Twitter The Next Advanced Child Tax Credit Payment Arrives This Friday August 13 Families Can Now Receive Their Monthly Payments Faster By Adding Or Updating Banking And Direct Deposit

Child Tax Credit Tax Refunds Could Bring Another 1 800 Per Kid Cnet

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

The Big Increase And More Changes To The Child Tax Credit In 2021 Gobankingrates

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

December Child Tax Credit What To Do If It Doesn T Show Up Wusa9 Com